Some commonly asked questions

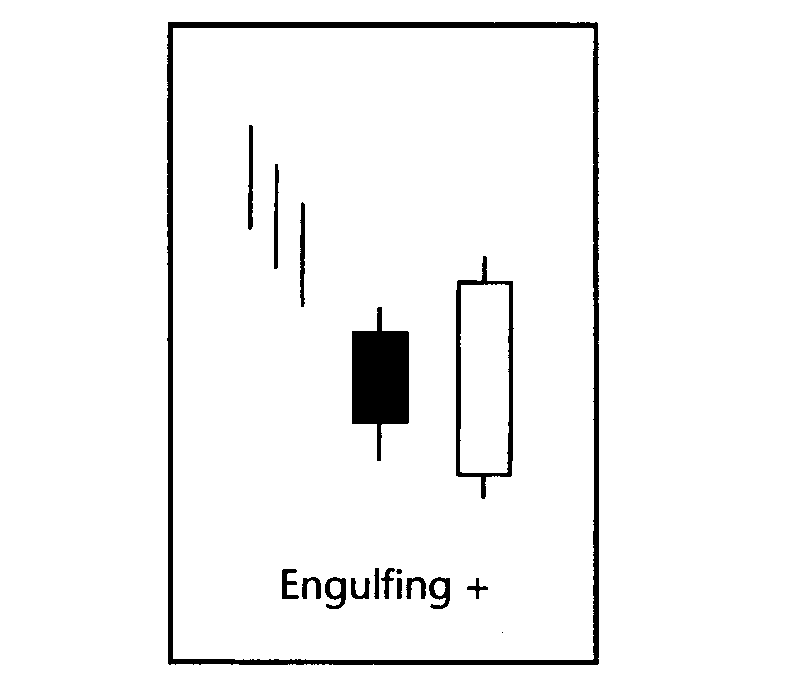

Engulfing Bullish Reversal

- Stock should be in a downward trend

- Large white candlestick today

- Small red candlestick yesterday

- Today's candlestick completely engulfs the body of yesterday

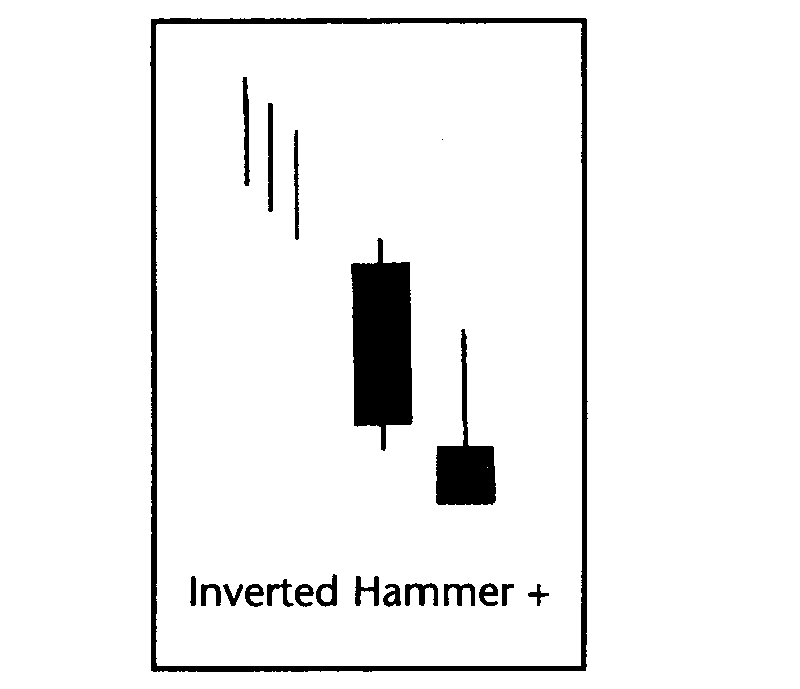

Inverted Hammer Bullish

- Stock should be in a downward trend

- Large upper shadow or wick today

- Yesterday is a dark candlestick

- Today's open below or at the level of the yesterday's close

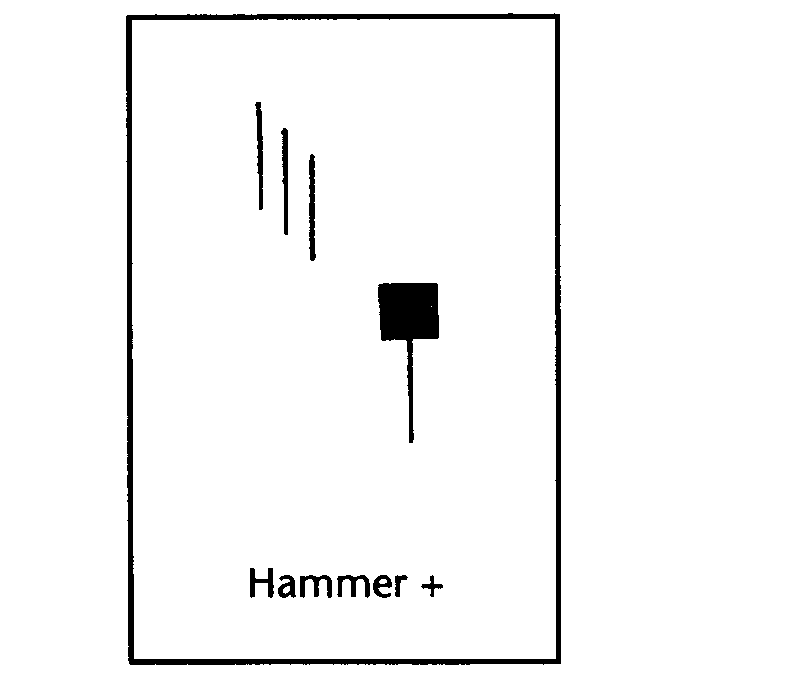

Hammer Bullish

- Stock should be in a downward trend

- Large lower shadow or wick today

- Open and high of today are the same

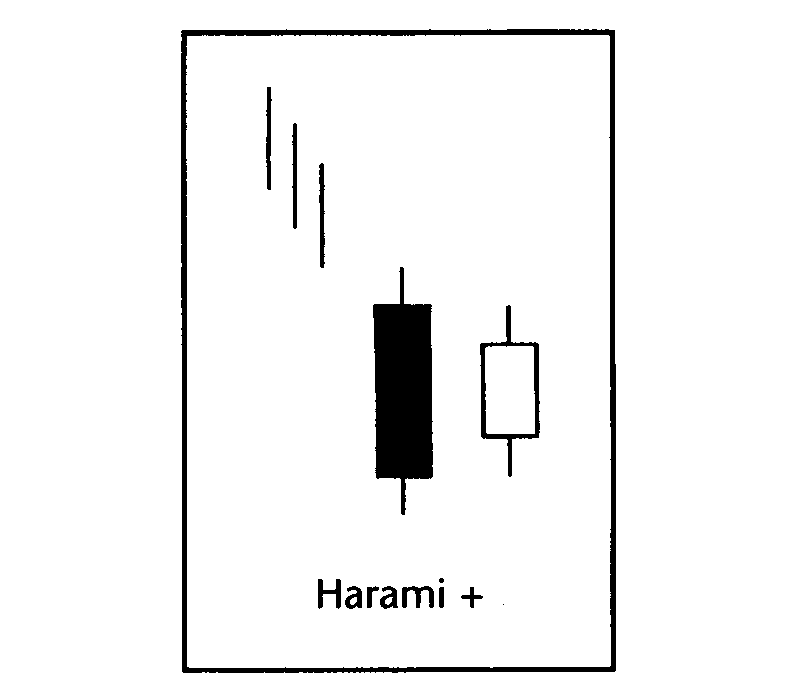

Harami Bullish

- Stock should be in a downward trend

- Today is small white candlestick

- Yesterday is a long dark candlestick

- Body of today's candlestick is engulfed by body of yesterday's candlestick

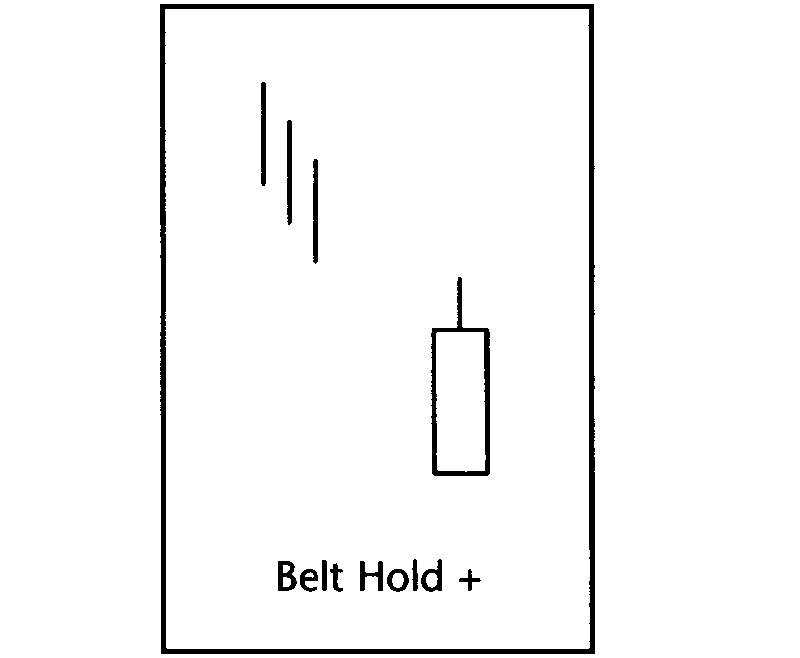

Belt Hold Bullish (Low Reliability)

- Stock should be in a downward trend

- Today is a long white candlestick

- Opening price today is also the low of the day

- Small upper wick

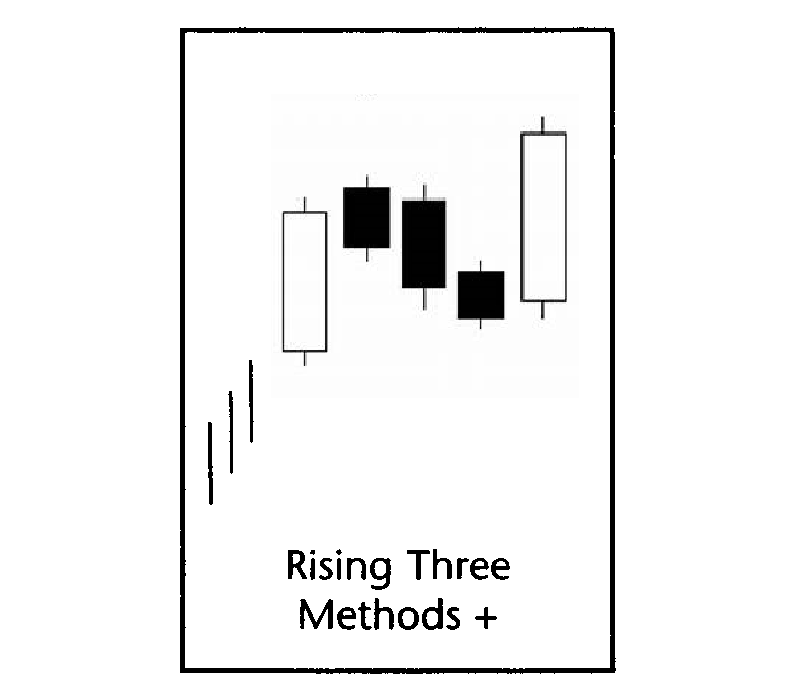

Rising Three Methods Bullish

- Five day pattern where today is Day 5

- Stock should be a upward trend

- Day 1 is a long white candlestick

- Day 2, Day 3 and Day 4 are dark candlesticks trading within high and low of day candlestick

- Today or Day 5 is a long white candlestick that close higher then Day 1

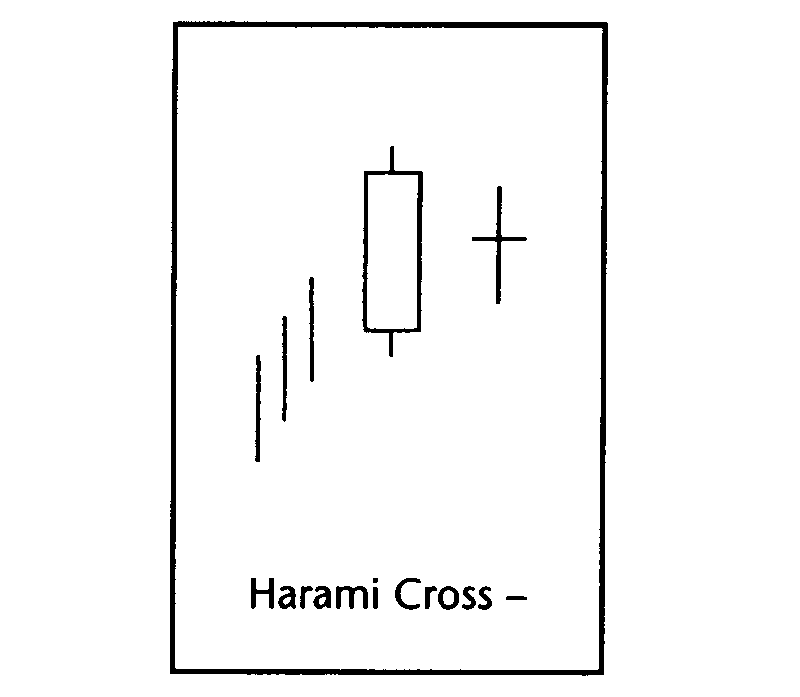

Harami Cross Bearish

- Stock should be in a upward trend

- Yesterday is a long white candlestick

- Today is a Doji. Open and close are the same

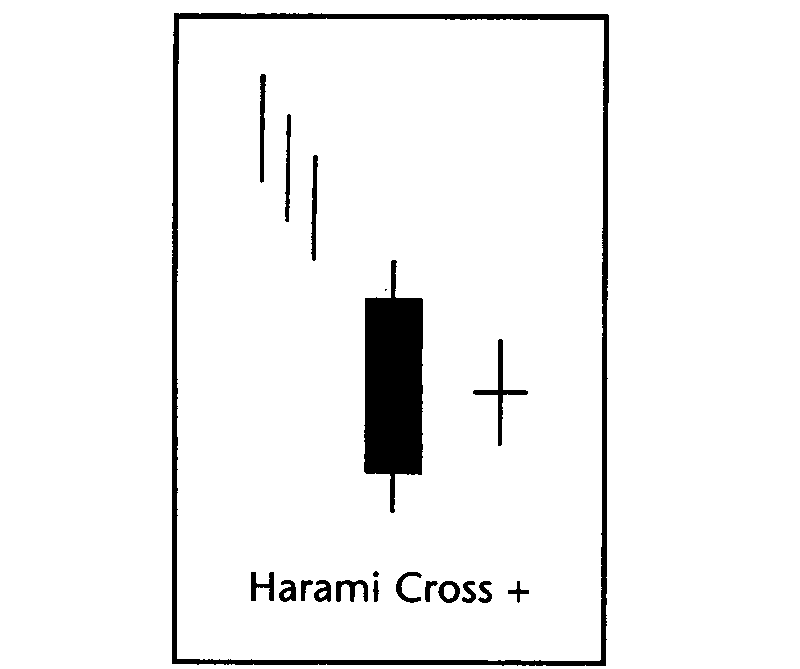

Harami Cross Bullish

- Stock should be in a downward trend

- Yesterday is a long dark candlestick

- Today is a Doji. Open and close are the same

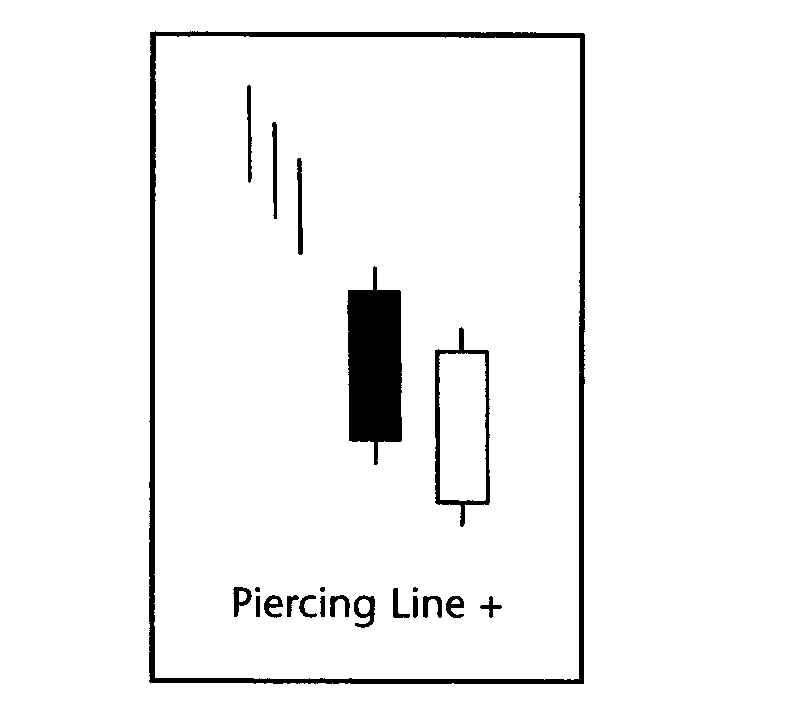

Piercing Line Bullish

- Stock should be in a downward trend

- Yesterday is a long dark candlestick

- Today is a long white candlestick

- Today close is equal or above the mid point of yesterday's open and close

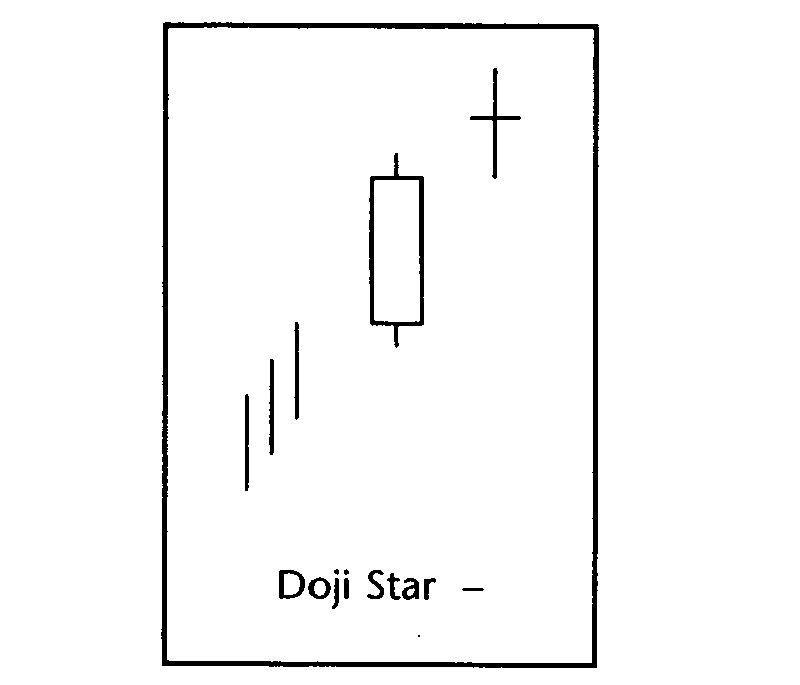

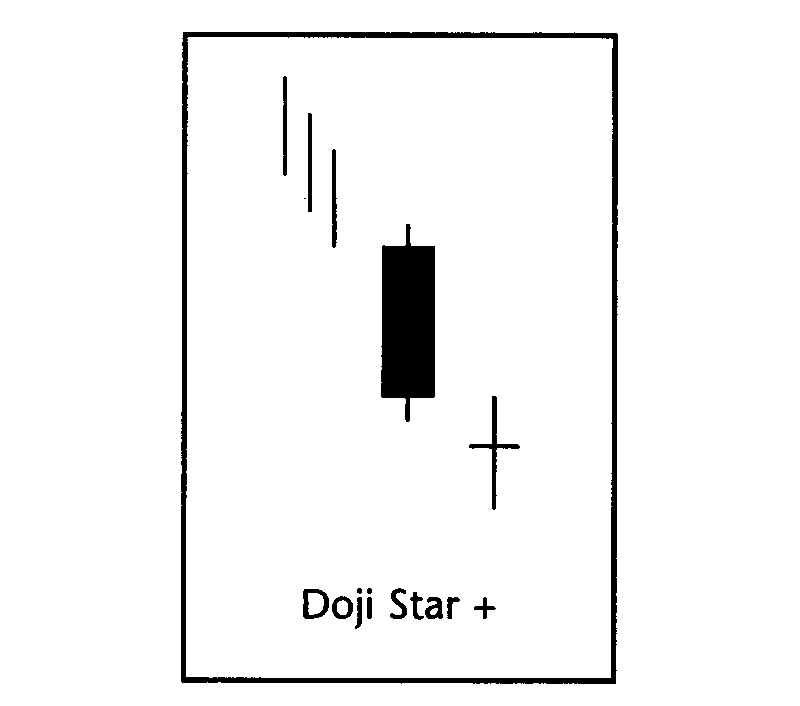

Doji Star Bullish

- Stock should be in a downward trend

- Yesterday is a long dark candlestick

- Today is a Doji star (Today open and close are the same)

- Today's open is near or equal to yesterday's close

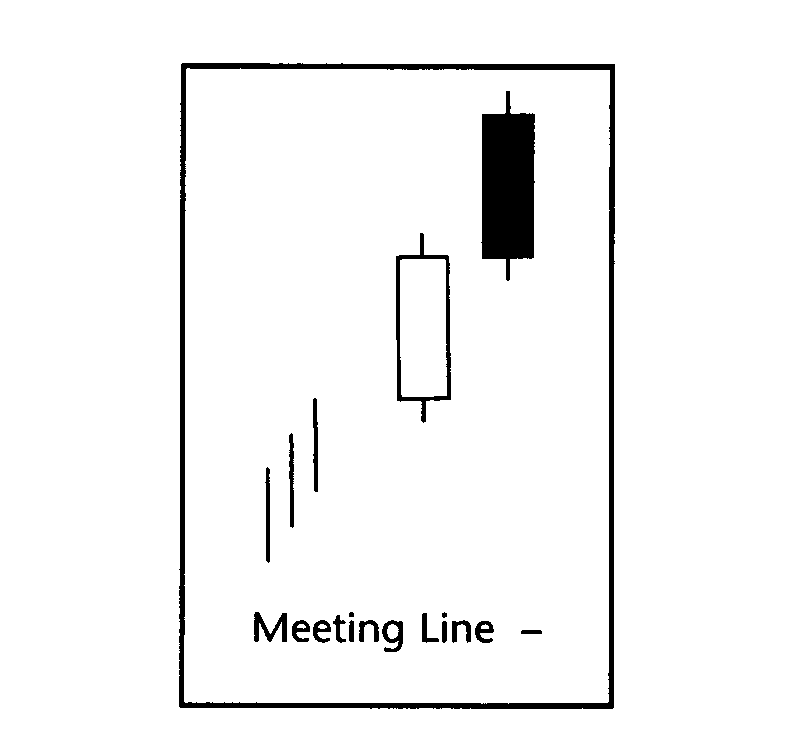

Meeting Lines Bearish

- Stock should be in a upward trend

- Yesterday is a long white candlestick

- Today is a long dark candlestick

- Today's open is higher than yesterday's close

- Today's close is equal to yesterday's close

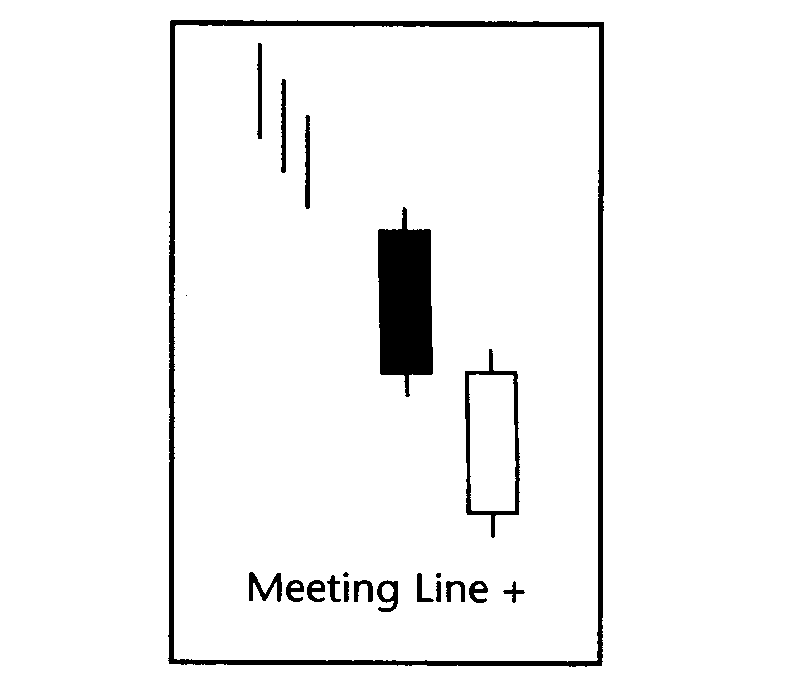

Meeting Lines Bullish

- Stock should be in a downward trend

- Yesterday is a long dark candlestick

- Today is a long white candlestick

- Today's open is lower than yesterday's close

- Today's close is equal to yesterday's close

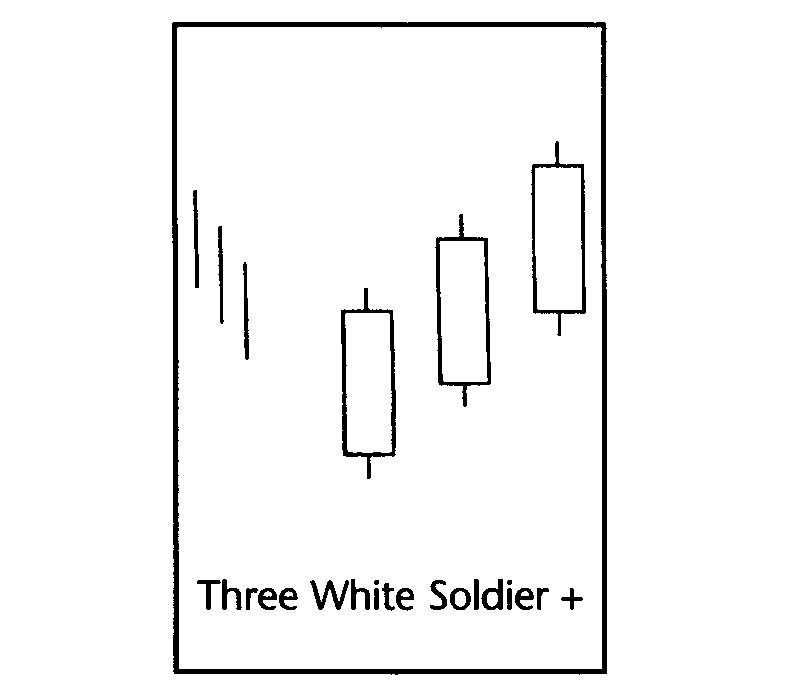

Three White Soldiers Bullish

- Stock should be in a downward trend

- Three consecutive days of long white candlesticks

- Each day the open should be within open and close of the previous day

- Every day the close is above the close of the day before

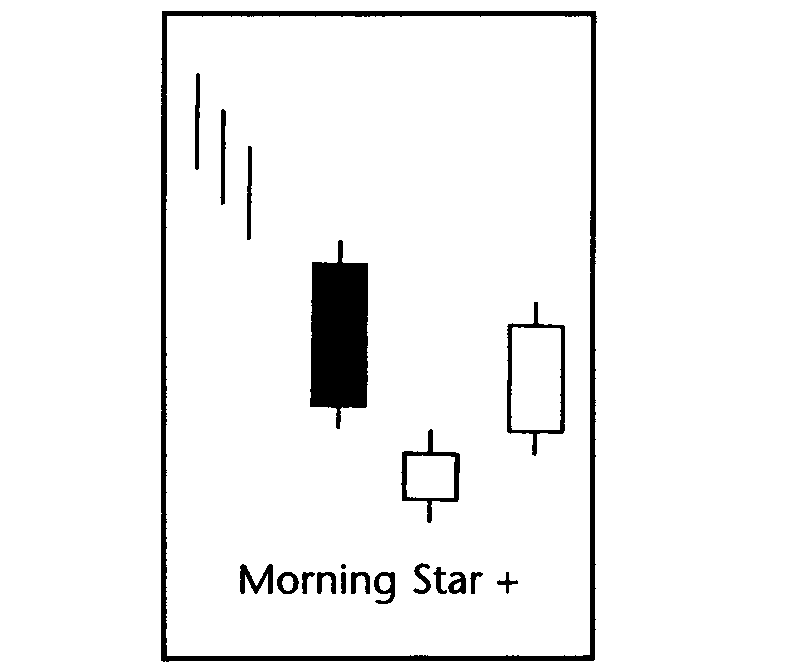

Morning Star Bullish

- Stock should be in a downward trend

- Three day trend where today is day 3

- First day is a long dark candlestick

- Day 2 or yesterday is a small dark or white candlestick that closes below day 1 close

- Day 3 or today is a long white candlestick that opens above yesterday's high and closes near the middle of day 1 candlestick

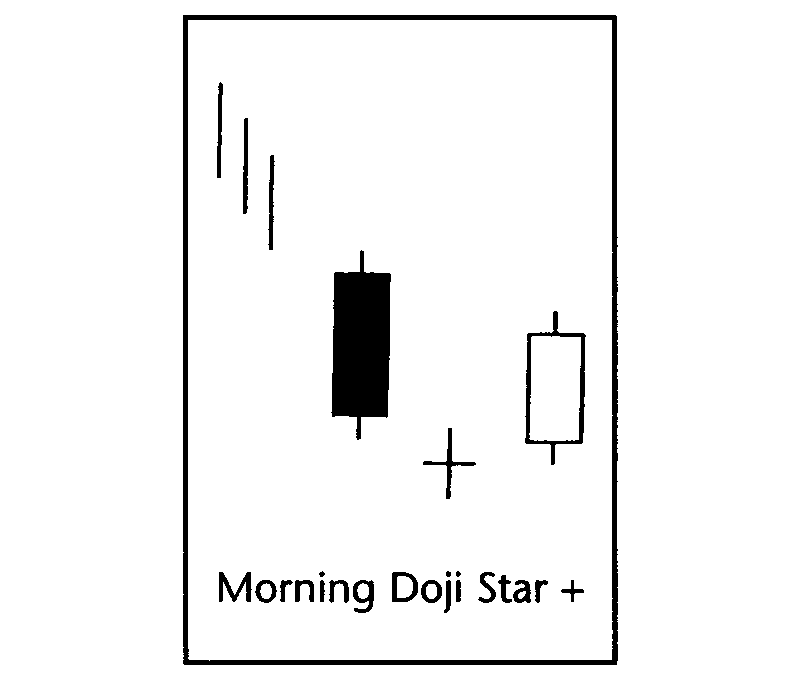

Morning Doji Star Bullish

- Stock should be in a downward trend

- Three day trend where today is day 3

- First day is a long dark candlestick

- Day 2 or yesterday is a Doji star where open and close are equal.

- Day 2 or yesterday closes below day 1

- Day 3 or today is a long white candlestick that opens above yesterday's high and closes near the open of day 1 candlestick

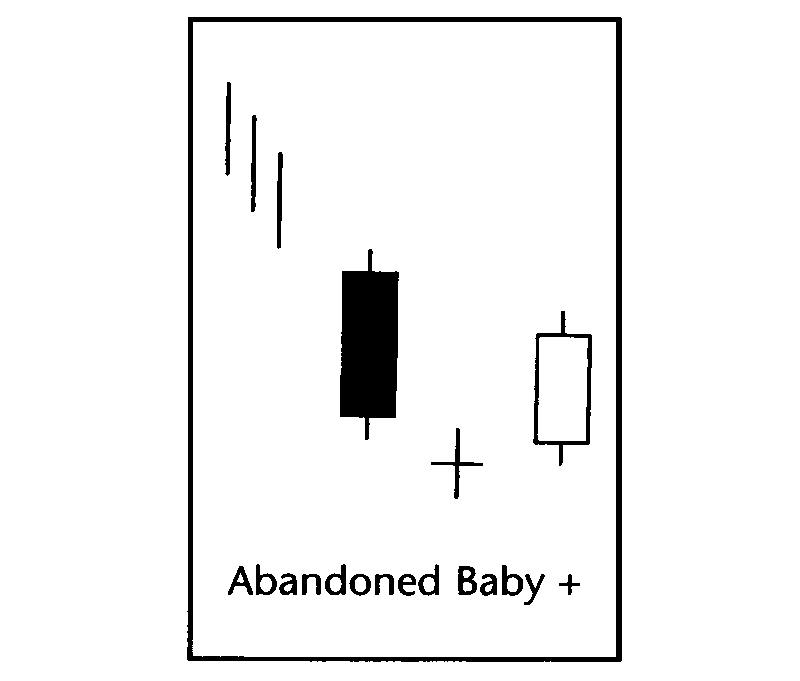

Abandoned Baby Bullish

- Stock should be in a downward trend

- Three day trend where today is day 3

- First day is a long dark candlestick

- Day 2 or yesterday is a Doji star where open and close are equal

- Day 2 or yesterday opens below Day 1 low and closes below day 1

- Day 3 or today is a long white candlestick that opens above yesterday's high and closes near the open of day 1 candlestick

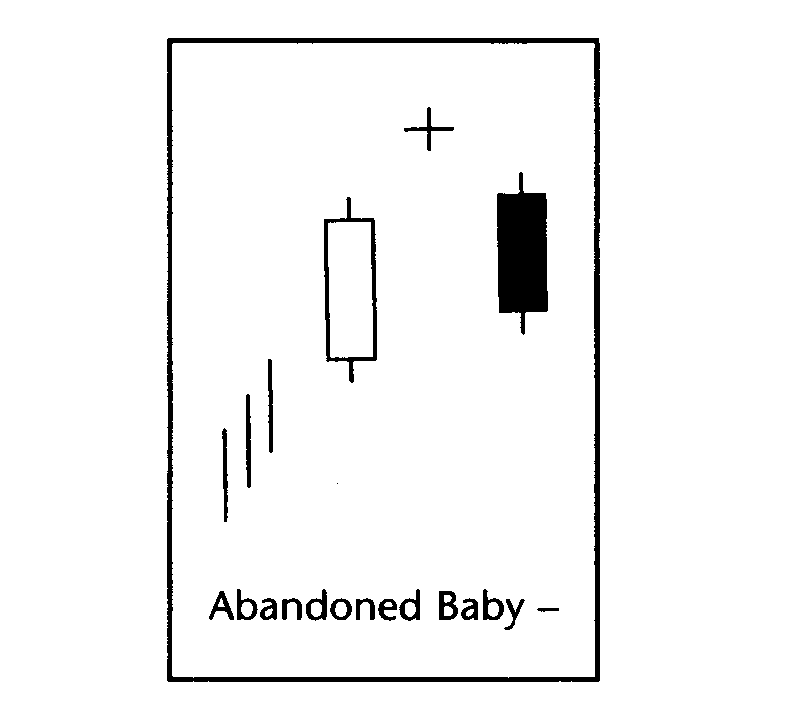

Abandoned Baby Bearish

- Stock should in a upward trend

- Three day trend where today is day 3

- First day is a long white candlestick

- Day 2 or yesterday is a Doji star where open and close are equal

- Day 2 or yesterday opens above Day 1 high and closes above Day 1

- Day 3 or today is a long dark candlestick that opens below yesterday's low and closes near the close of day 1 candlestick

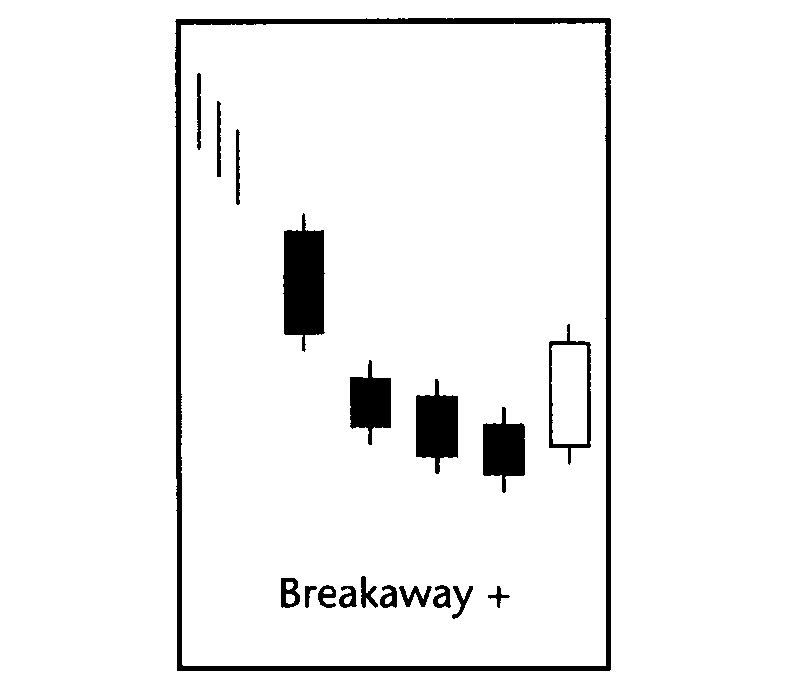

Breakaway Bullish

- Stock should be in a downward trend

- Five day pattern where today is day 5

- Day 1 is a long dark candlestick

- Day 2, 3, & 4 are dark candlesticks where each day closes below the previous day's close

- Day 5 or today is a long white candlestick where the close is within Day 1 open and close

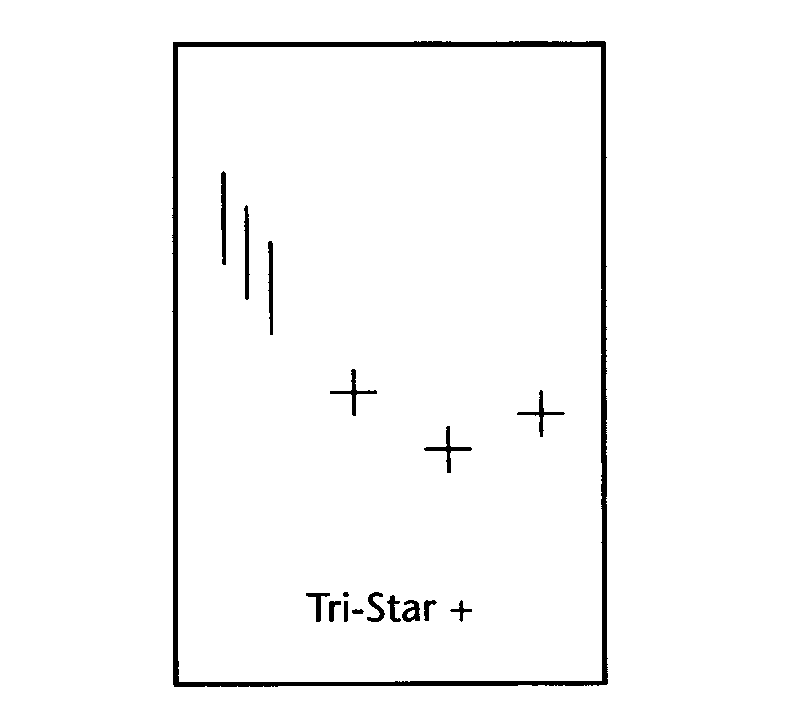

Tri Star Bullish

- Stock should be in a downward trend

- Three day pattern where today is day 3

- Three consecutive days of Doji star where open and close are the same

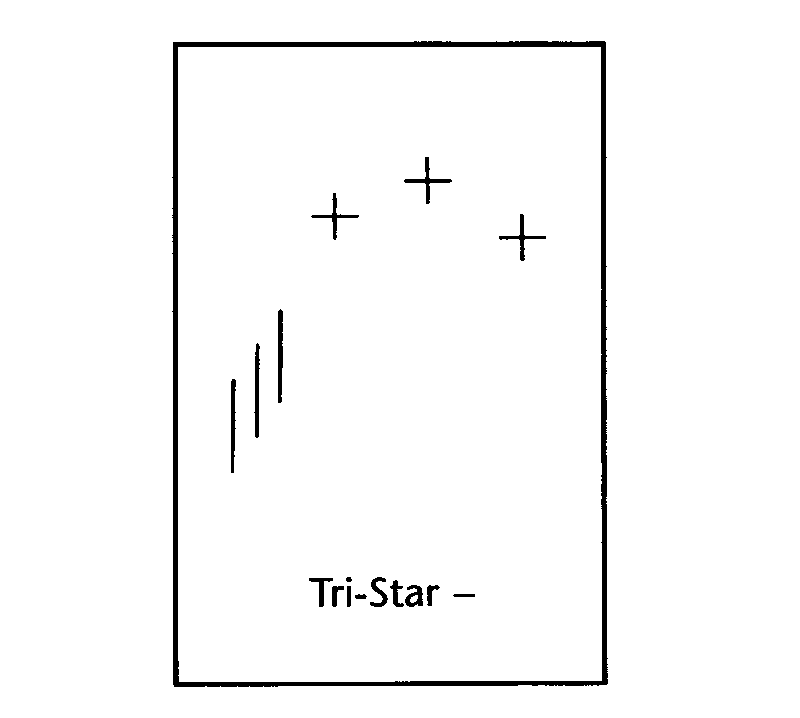

Tri Star Bearish

- Stock should be in a upward trend

- Three day pattern where today is day 3

- Three consecutive days of Doji star where open and close are the same

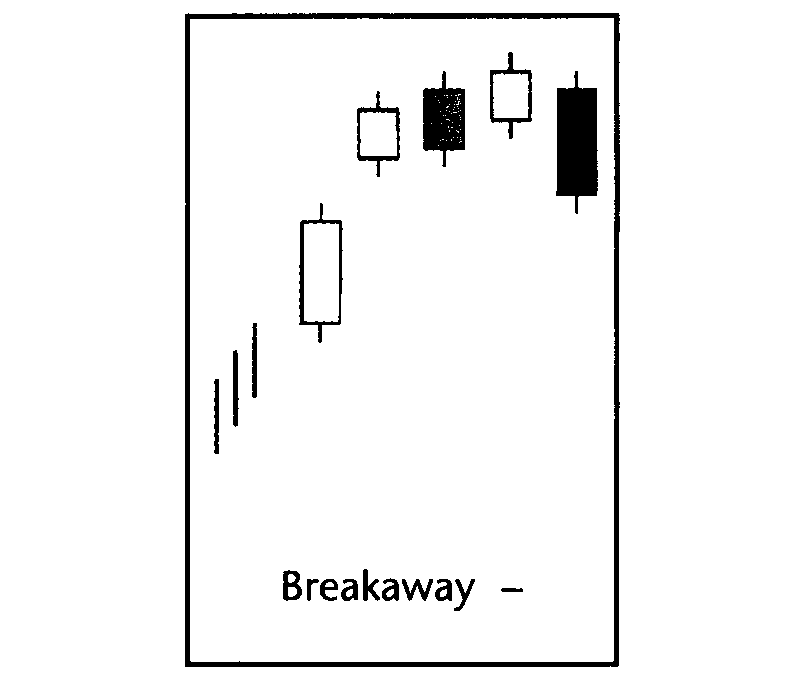

Breakaway Bearish

- Stock should be in a upward trend

- Five day pattern where today is day 5

- Day 1 is a long white candlestick

- Day 2, 3, & 4 are white candlesticks where each day closes above the previous day's close

- Day 5 or today is a long dark candlestick where the close is within Day 1 open and close

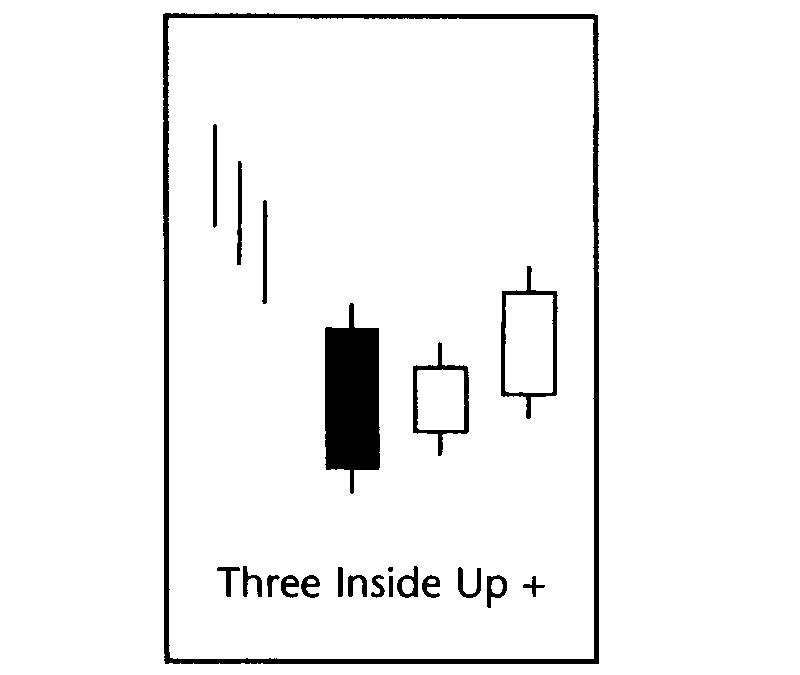

Three Inside Up Bullish

- Stock should be in a downward trend

- Three day pattern where today is day 3

- Day 1 is a long dark candlestick

- Day 2 or yesterday is a white candlestick and engulfed by Day 1's body

- Day 3 or today is a white candlestick where the close is above day 2 open

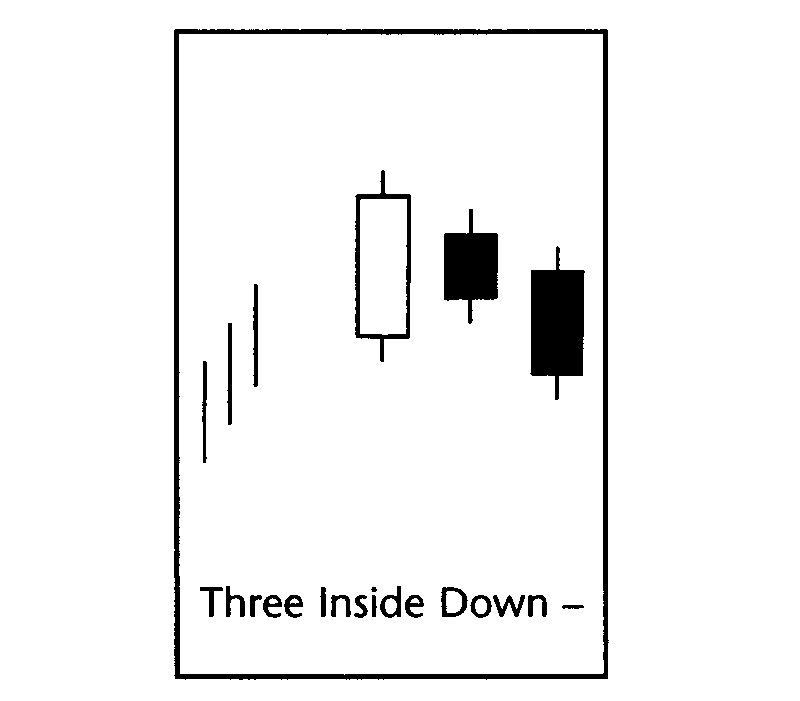

Three Inside Down Bearish

- Stock should be in a upward trend

- Three day pattern where today is day 3

- Day 1 is a long white candlestick

- Day 2 or yesterday is a dark candlestick and engulfed by Day 1's body

- Day 3 or today is a dark candlestick where the close is below day 2 open

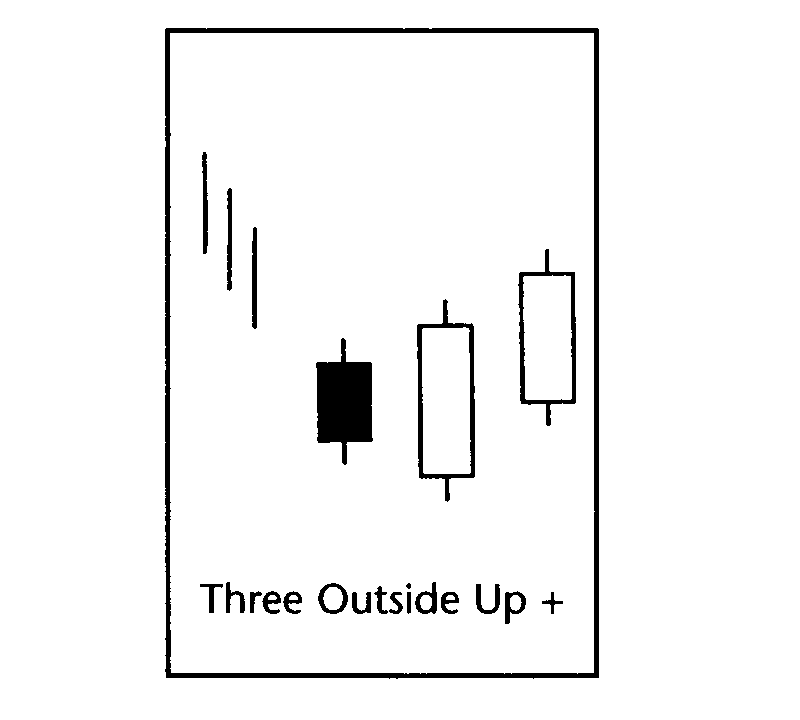

Three Outside Up Bullish

- Stock should be in a downward trend

- Three day pattern where today is day 3

- Day 1 is a dark candlestick

- Day 2 is a long white candlestick that engulfs the body of Day 1 and closes above Day 1 open

- Day 3 or today opens above Day 2 open and closes above day 2 close

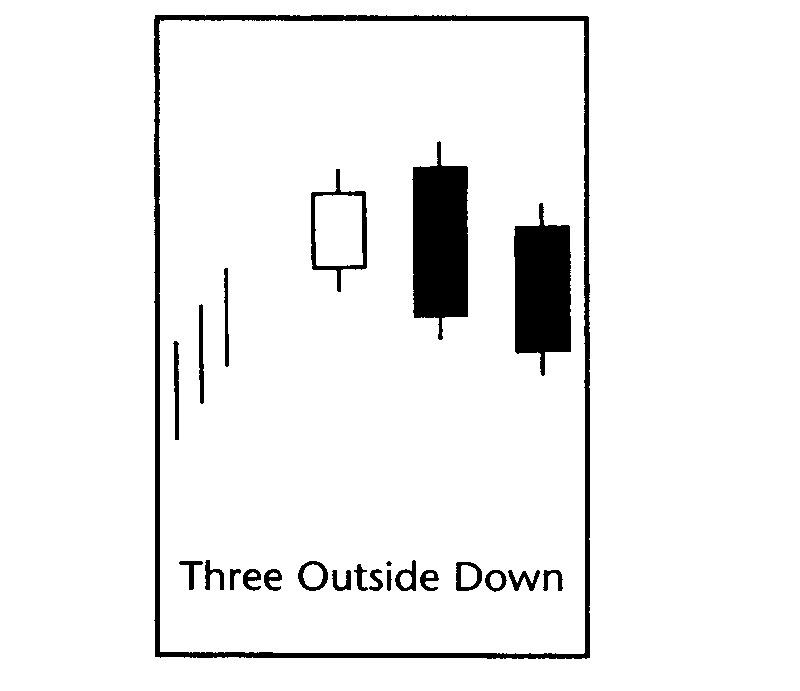

Three Outside Down Bearish

- Stock should be in a upward trend

- Three day pattern where today is day 3

- Day 1 is a white candlestick

- Day 2 is a long dark candlestick that engulfs the body of Day 1 and closes below Day 1 open

- Day 3 or today opens below Day 2 open and closes below day 2 close

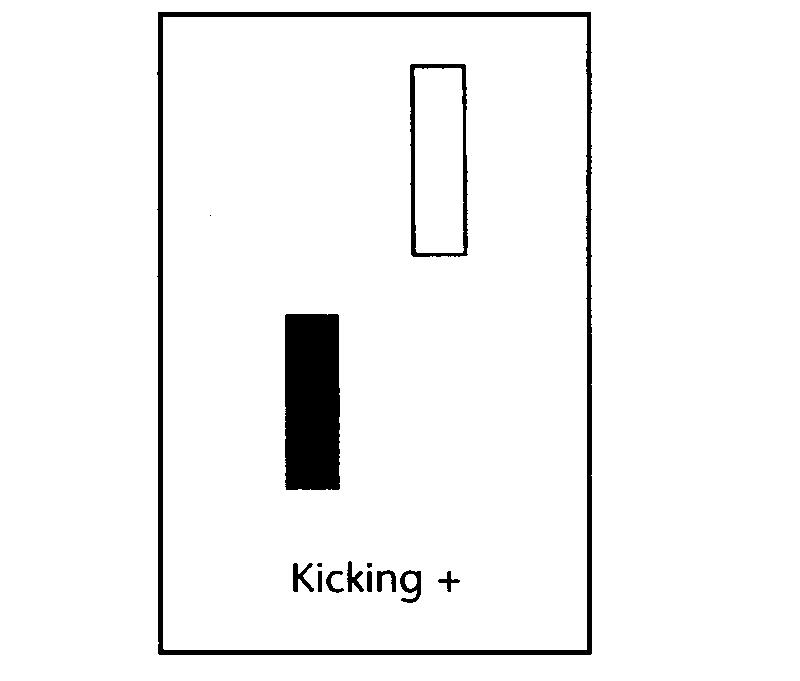

Kicking Bullish

- Yesterday is a dark candlestick

- Today is a white candlestick which gaps and opens above yesterday's high

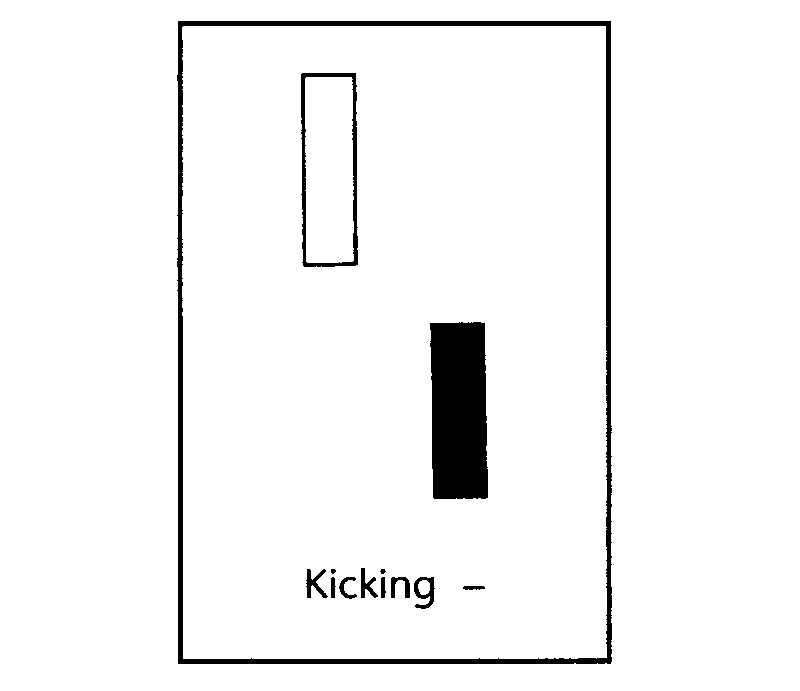

Kicking Bearish

- Yesterday is a white candlestick

- Today is a dark candlestick which gaps and opens below yesterday's low

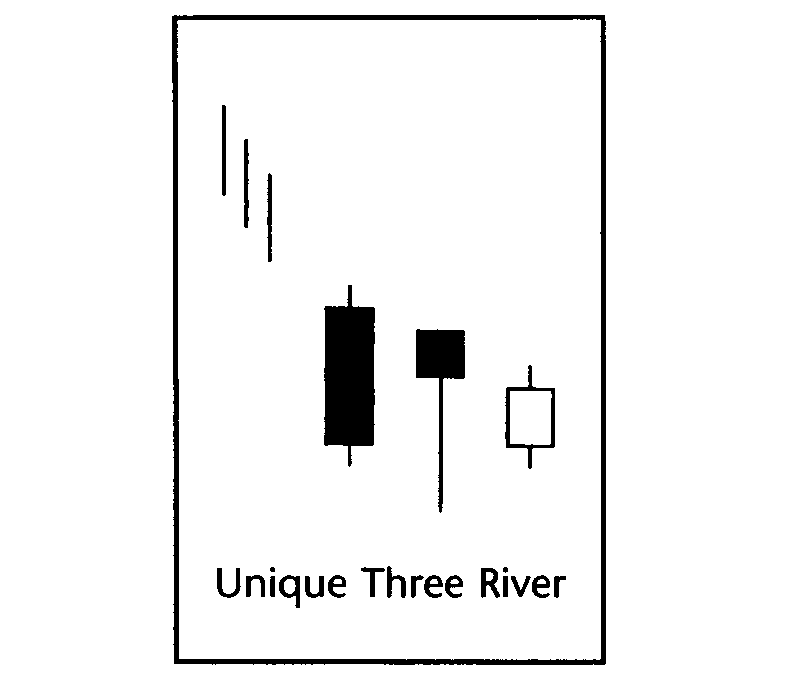

Unique Three River Bullish

- Stock should be in a downward trend

- Three day pattern where today is Day 3

- Day 1 is a long dark candlestick

- Day 2 or yesterday is a dark candlestick

- Day 2 or yesterday low is lower than Day 1

- Day 3 or today is a white candlestick but closes below yesterday's close

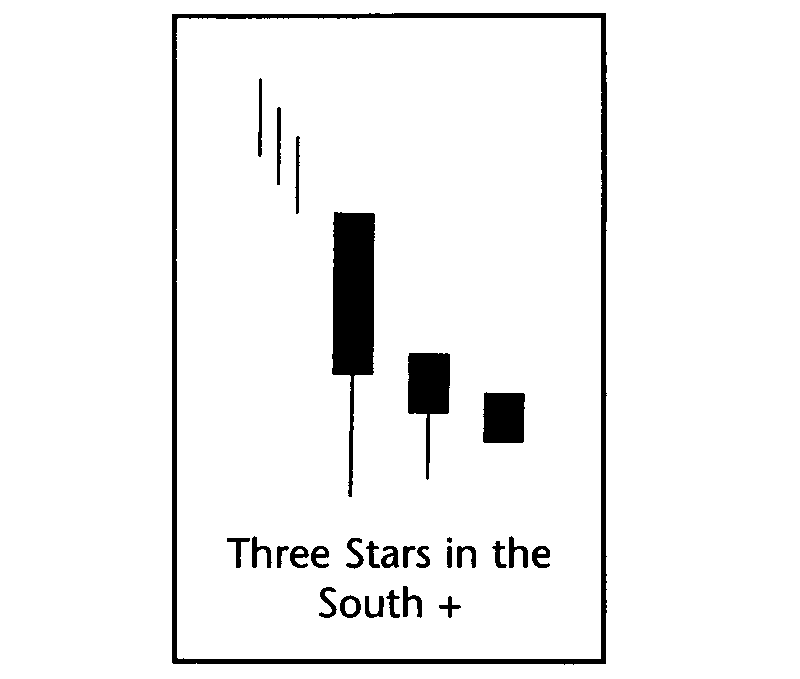

Three Stars Bullish

- Stock should be in a downward trend

- Three day pattern where today is Day 3

- Day 3 is a long dark candlestick with a long lower wick or shadow

- Day 2 or yesterday is a dark candlestick where the open is below Day 3 open and close is below Day 3 close

- Day 1 or today is a dark candlestick where high and low are within Day 2 high and low

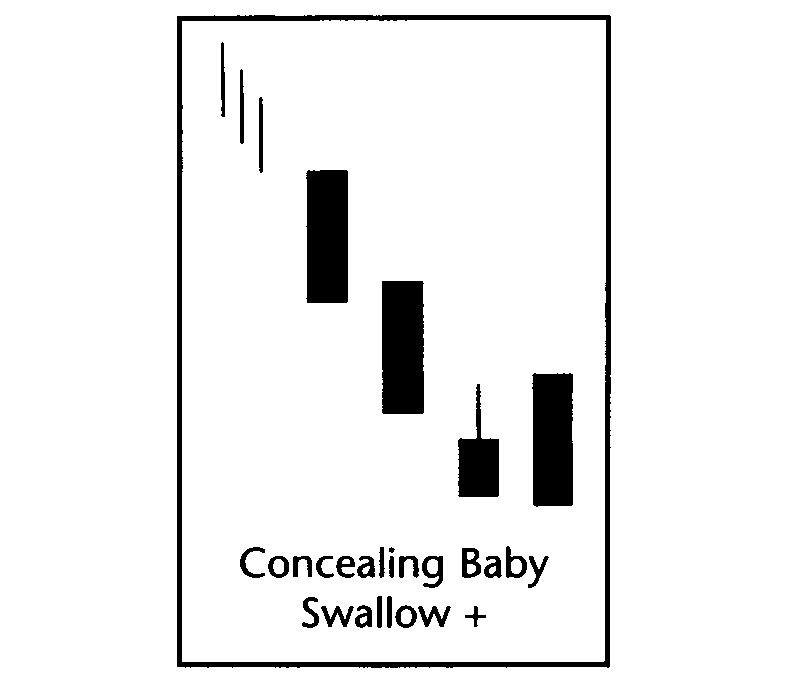

Concealing Swallow Bullish

- Stock should be in a downward trend

- Four day pattern where today is Day 4

- Day 1 and Day 2 are long dark candlesticks

- Day 3 or yesterday is a dark candlestick that opens below Day 2 low

- Day 3 or yesterday high is within Day 2 open and close

- Day 4 or today is a long dark candlestick that engulfs Day 3 or Yesterday

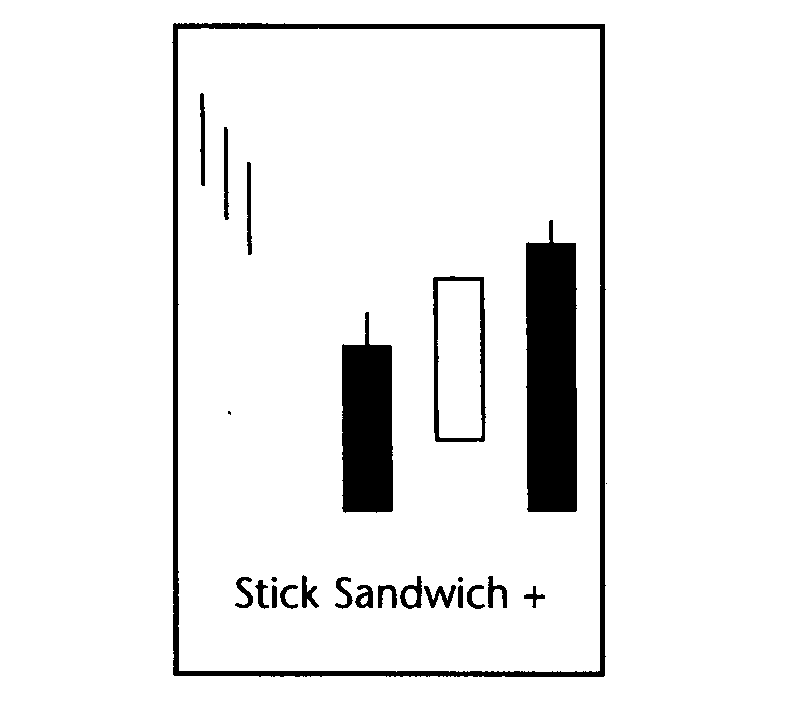

Stick Sandwich Bullish

- Stock should be in a downward trend

- Three day pattern where today is Day 3

- Day 1 is a long dark candlestick

- Day 2 open and close is between Day 3 open and close

- Day 3 or today is a dark candlestick that closes near Day 1's close

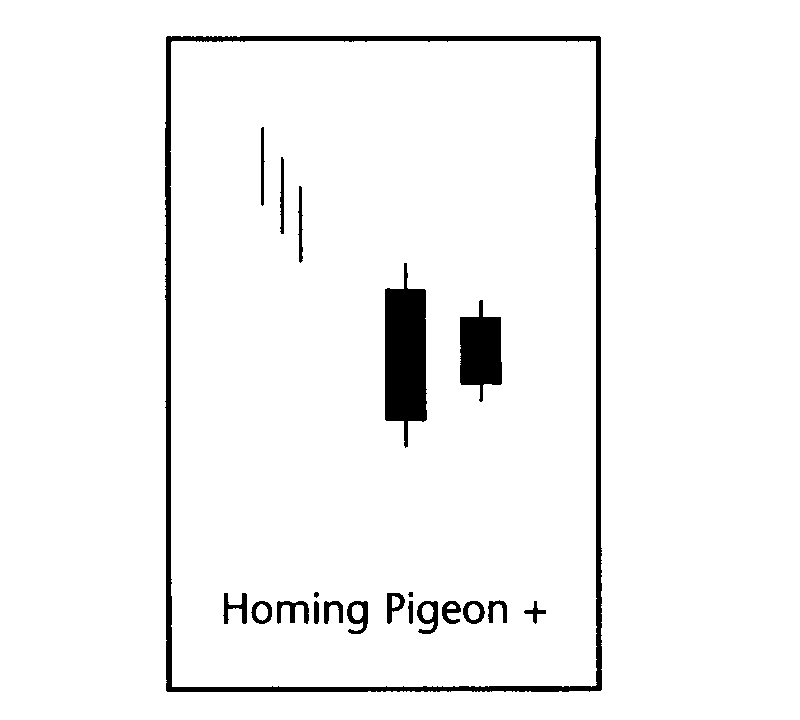

Homing Pigeon Bullish

- Stock should be in a downward trend

- Yesterday is a long dark candlestick

- Today is a dark candlestick

- Today's open and close are within yesterday's open and close

Ladder Bottom Bullish

- Stock should be in a downward trend

- Five day pattern where today is Day 5

- Day 1, Day 2, Day 3 are dark candlesticks

- Day 2 close is lower than Day 1 close

- Day 3 close is lower than Day 2 close

- Day 4 close is lower than Day 3 close with long upper wick or shadow

- Day 5 or today is a white candlestick that opens above Day 4 open

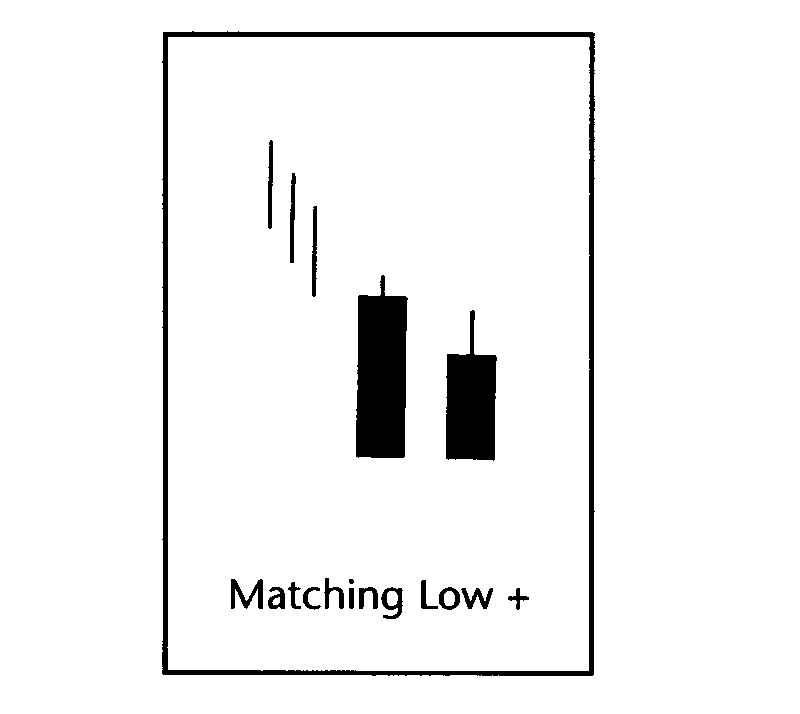

Matching Low Bullish

- Stock should be in a downward trend

- Yesterday is a long dark candlestick

- Today is a dark candlestick and the close is near or equal to yesterday's close

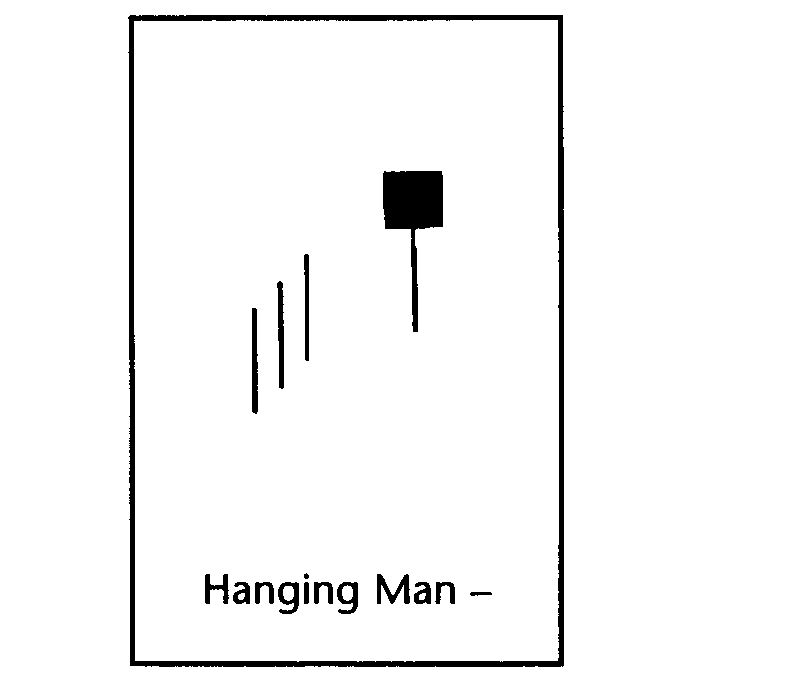

Hanging Man Bearish

- Stock should be in a upward trend

- Today is a dark or white candlestick

- Today's lower shadow or wick is at least twice the length of the open and high

- Today's upper shadow is little or none

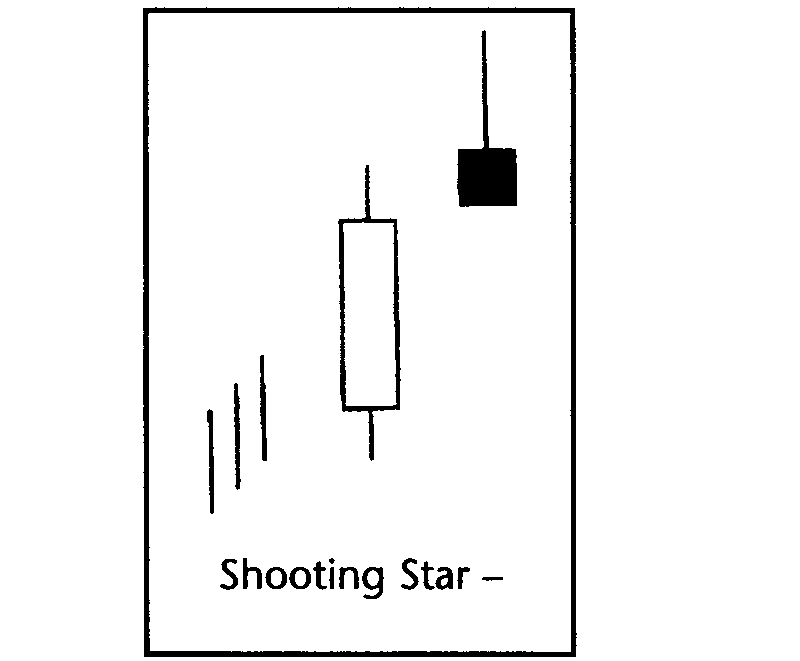

Shooting Star Bearish

- Stock should be in a upward trend

- Yesterday is a long white candlestick

- Today is a small body (open and close)

- Today has a long upper wick or shadow

- Today has little or no lower shadow

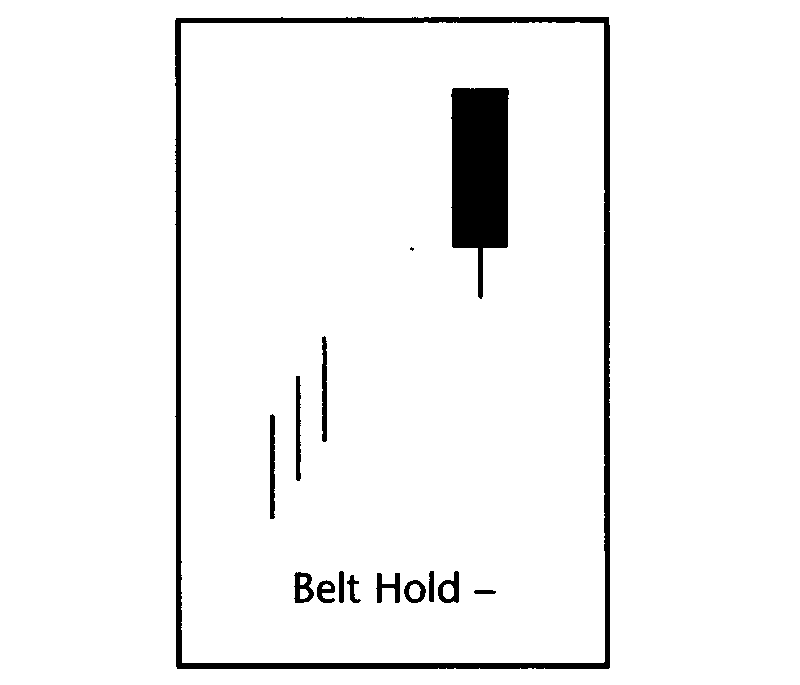

Belt Hold Bearish

- Stock should be in a upward trend

- Yesterday is a white candlestick

- Today is a long dark candlestick

- Today has little or no upper wick or shadow

- Today has short lower shadow

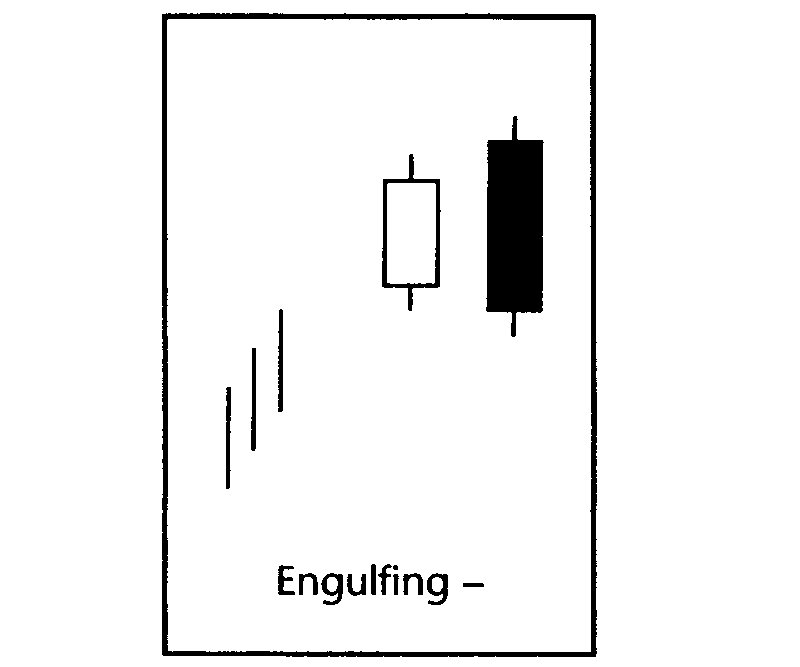

Engulfing Bearish

- Stock should be in a upward trend

- Yesterday is a white candlestick

- Today is a long dark candlestick

- Today engulfs yesterday's high and low range

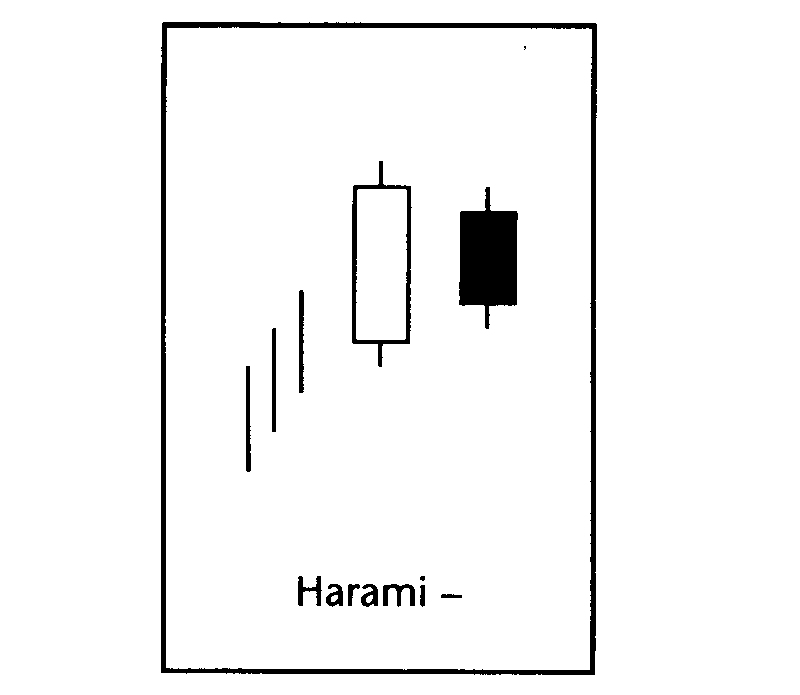

Harami Bearish

- Stock should be in a upward trend

- Yesterday is a long white candlestick

- Today is a small dark candlestick

- Yesterday's body completely engulfs today's body

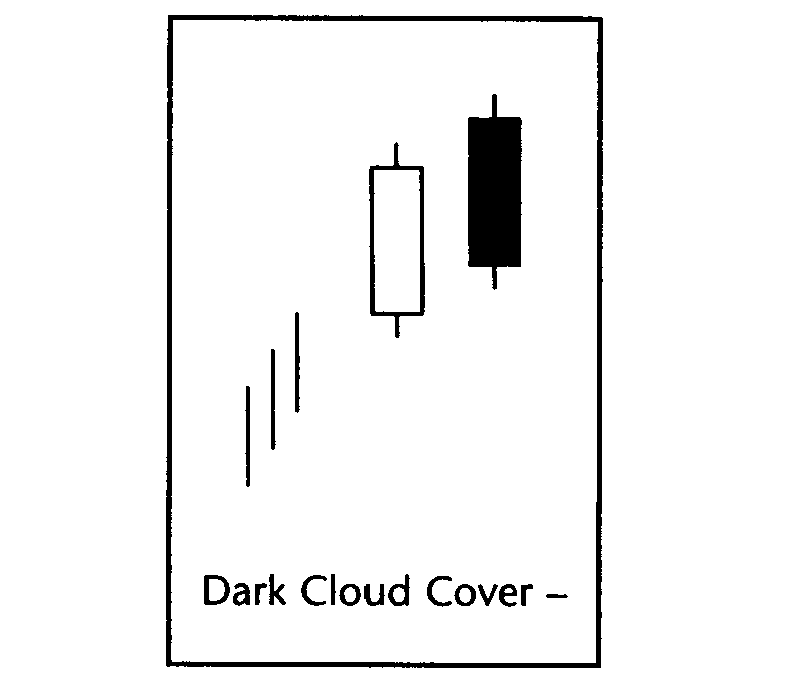

Dark Cloud Bearish

- Stock should be in a upward trend

- Yesterday is a long white candlestick

- Today is a long dark candlestick

- Today's open is above yesterday's high

- Today's close is near the mid point of yesterday's open and close

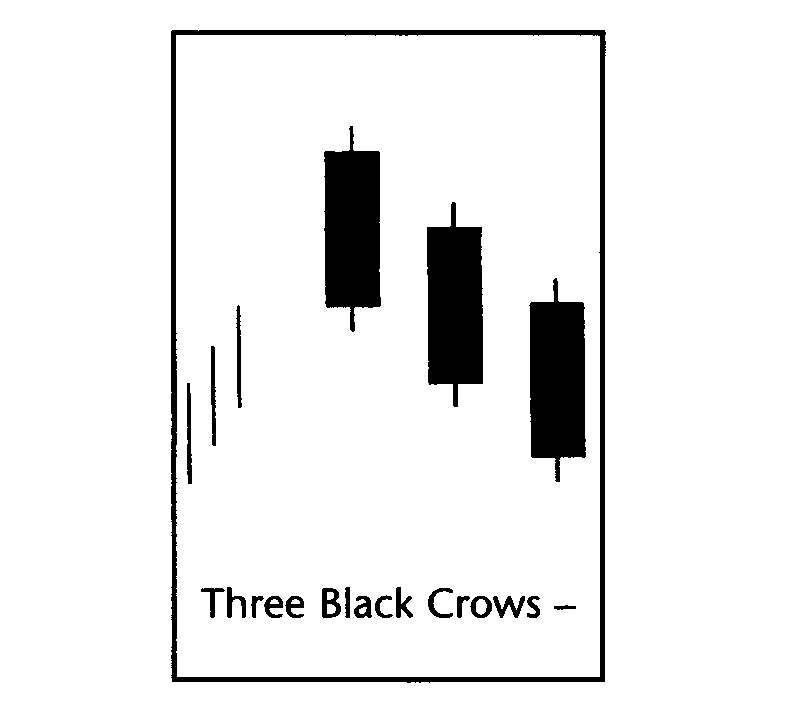

Three Black Crows Bearish

- Stock should be in a upward trend

- Three day pattern where today is Day 3

- Day 1, Day 2 & Day 3 are dark candlesticks

- Day 2 opens within previous open and close

- Day 3 opens within previous open and close

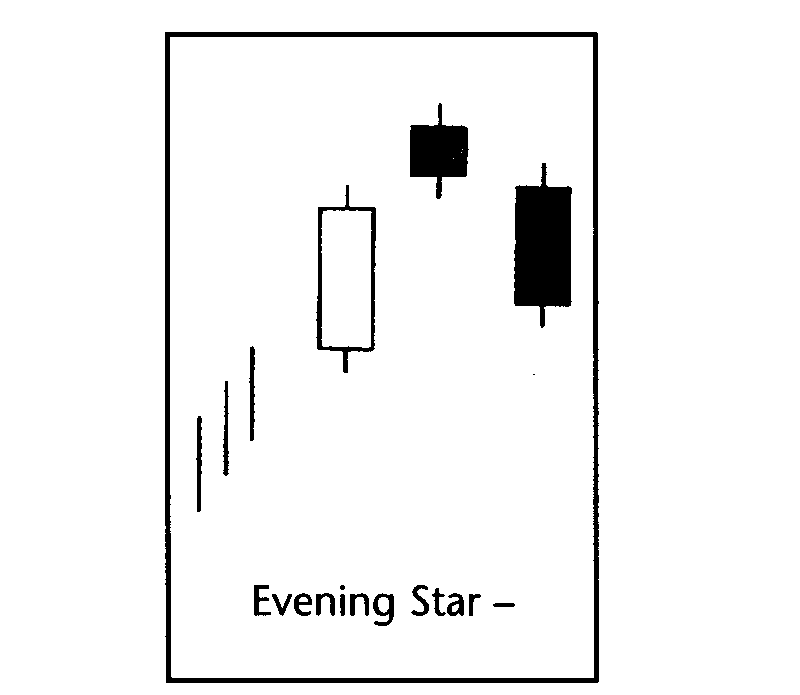

Evening Star Bearish

- Stock should be in a upward trend

- Three day pattern where today is Day 3

- Day 1 is a long white candlestick

- Day 2 is a small dark or white candlestick which closes above Day 1 close

- Day 3 or today is a long dark candlestick

- Day 3 opens near or below Day 2 close and closes below Day 2 close

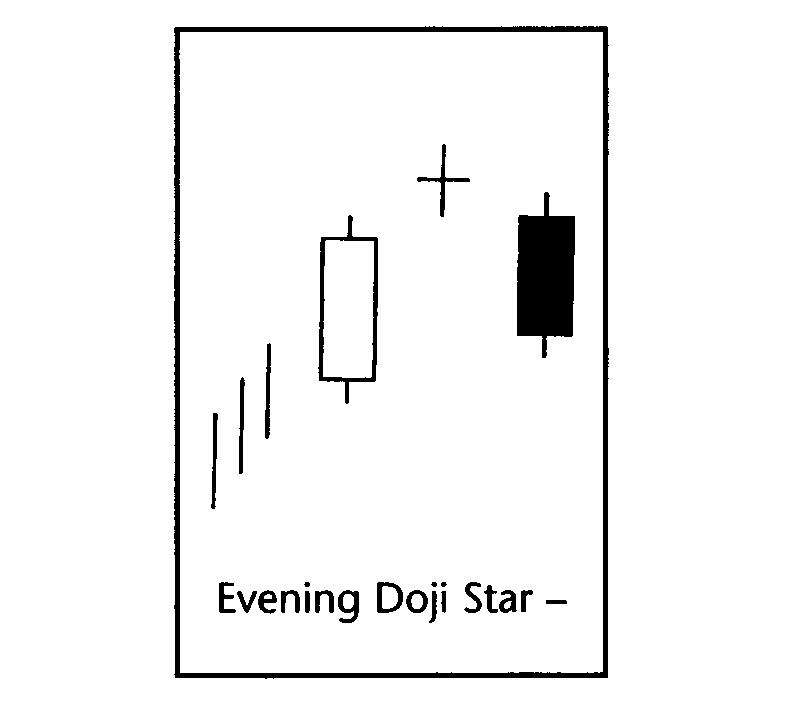

Evening Doji Star Bearish

- Stock should be in a upward trend

- Three day pattern where today is Day 3

- Day 1 is a long white candlestick

- Day 2 is a Doji Star where open and close are same

- Day 2 close is higher or equal to Day 1 close

- Day 3 or today is a dark candlestick

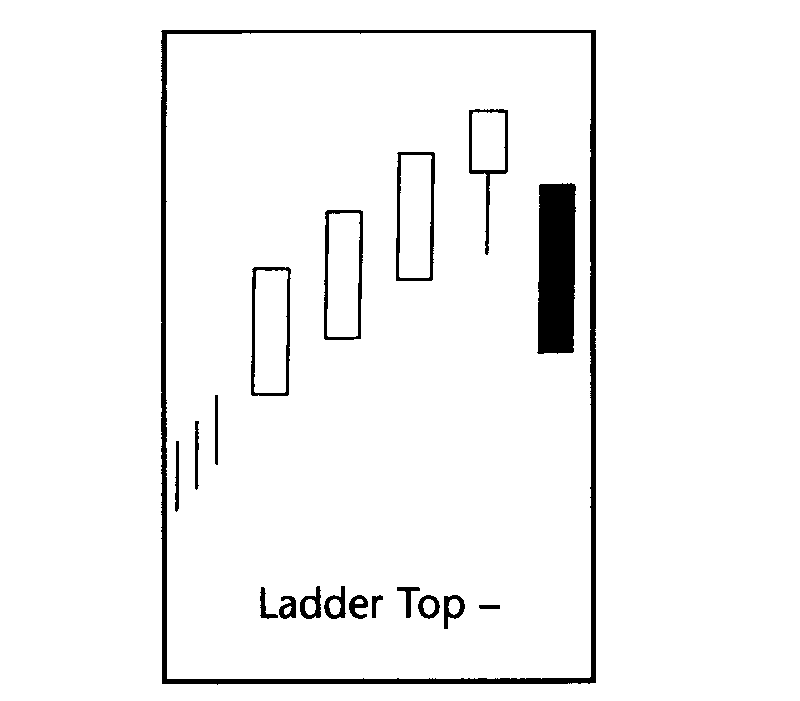

Ladder Top Bearish

- Stock should be in a upward trend

- Five day pattern where today is Day 5

- Day 1, Day 2, & Day 3 are long white candlesticks

- Day 4 is a white candlestick with long wick or shadow

- Day 5 or today is a dark candlestick

- Day 5 or today opens below the Day 4's open

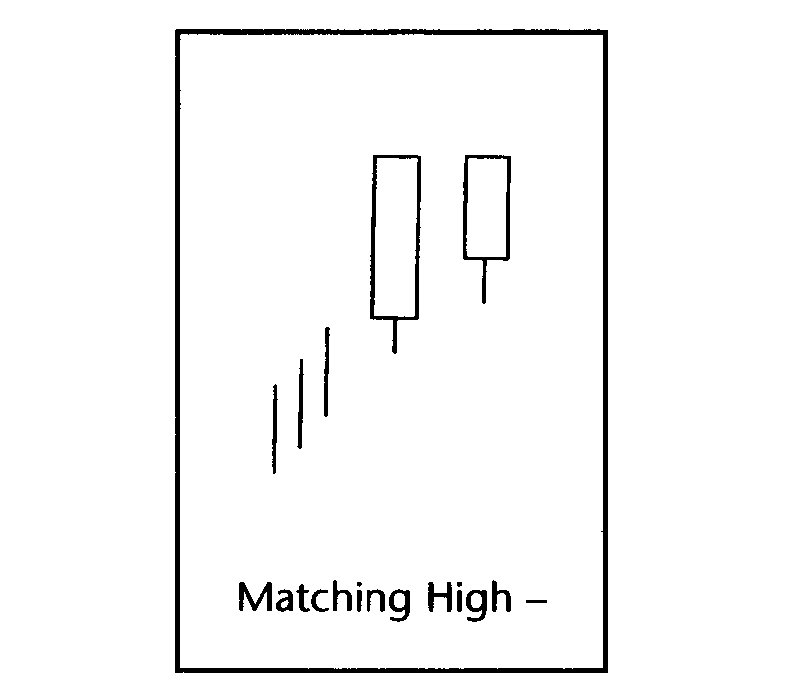

Matching High Bearish

- Stock should be in a upward trend

- Yesterday is a long white candlestick

- Today is a white candlestick

- Today's close is the same as yesterday's close

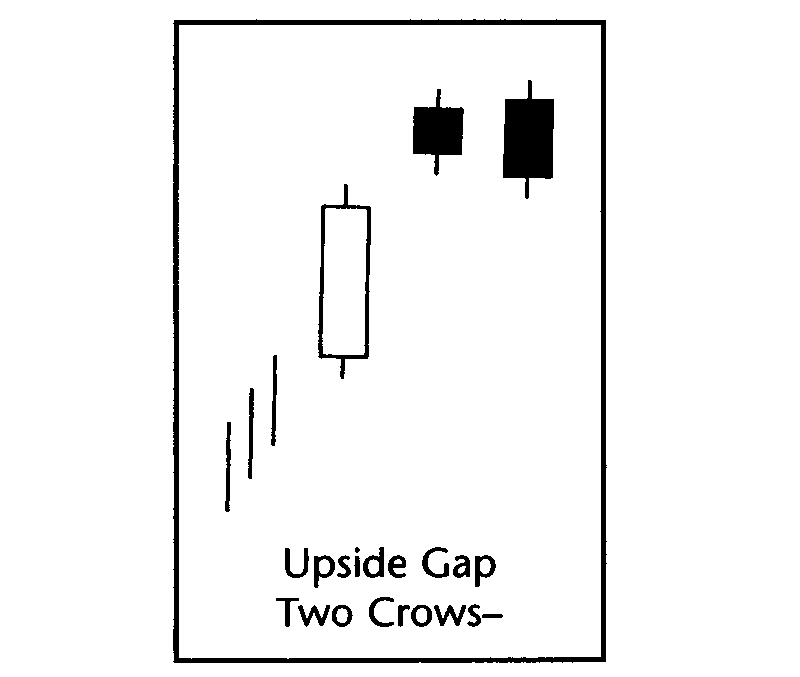

Upside Gap Two Crows Bearish

- Stock should be in a upward trend

- Three day pattern where today is Day 3

- Day 1 is a long white candlestick

- Day 2 is a short dark candlestick that closes above Day 1's high

- Today is a dark candlestick that engulfs Day 2's open and close

- Today's close is below yesterday's close

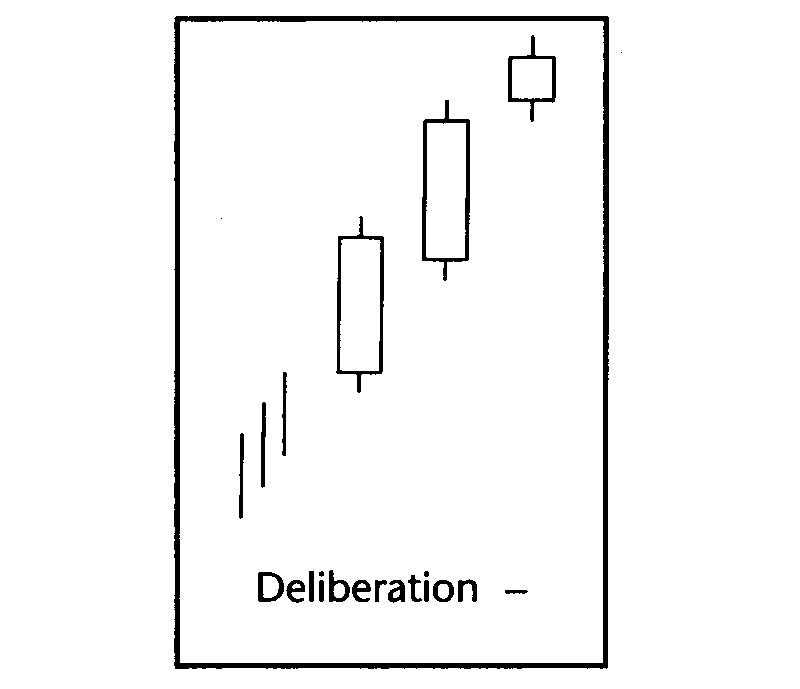

Deliberation Bearish

- Stock should be in a upward trend

- Three day pattern where today is Day 3

- Day 1 is a long white candlestick

- Day 2 is a long white candlestick that opens within Day 1's open and close

- Day 3 or today is a white candlestick that opens above the close of Day 2

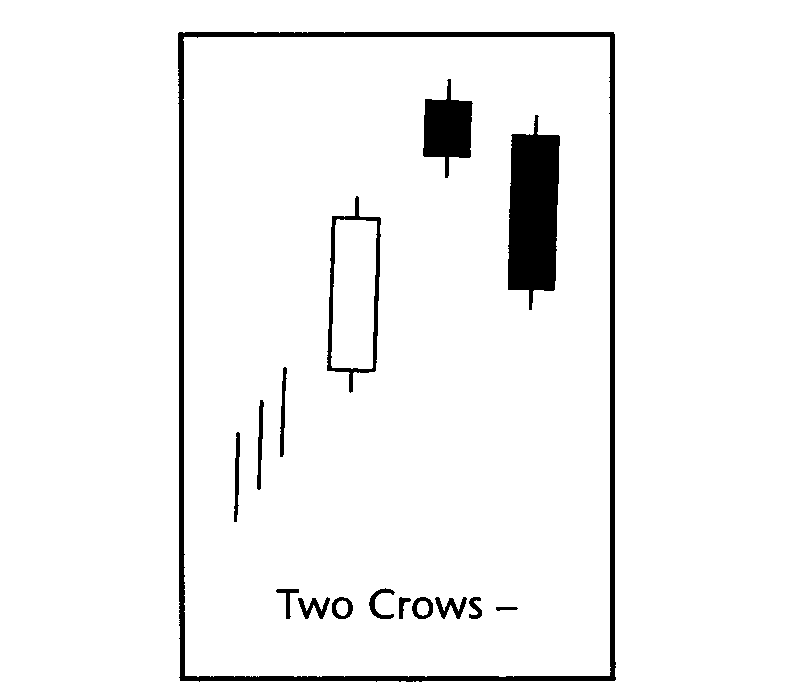

Two Crows Bearish

- Stock should be in a upward trend

- Three day pattern where today is Day 3

- Day 1 is a long white candlestick

- Day 2 is a dark candlestick

- Day 2 opens and closes above Day 1's high

- Day 3 or today opens within the Day 2's open and close

- Day 3 or today closes within the Day 1's open and close

Doji Star Bearish

- The market is characterized by a prevailing uptrend

- On the first day a white candlestick is observed

- Then, we see a Doji on the second day that gaps up